nebraska sales tax calculator vehicle

The documentation fee is set by the dealer but is not negotiable so clarify upfront what the dealer charges. View the Nebraska state fee estimator to verify your registration cost and use our DMV Override to adjust the calculator.

Connecticut Sales Tax Calculator Reverse Sales Dremployee

If the vehicle sells for 16000 the tax is 16000 multiplied by 6.

. Under the pre-1998 system motor vehicles were assigned a value by the Tax Commissioner based on average sales price for vehicles of that make age and model and the local property taxing units of government merely assessed the rate against that. Depending on the state the rebate may or may not be taxed accordingly. Because this trucks MSRP is about 40000 the first year of motor vehicle tax is 700.

For vehicles that are being rented or leased see see taxation of leases and rentals. For example purchasing a vehicle at 30000 with a cash rebate of 2000 will have sales tax calculated based on. A Nebraska motor vehicle bill of sale is a legal document that provides information with regard to the seller buyer and vehicle to prove that a legal sale was executed between the parties.

Nebraska vehicle registration fee calculator Sales tax. The type of license plates requested. The state in which you live.

The cost to register your car in the state of NE is 15. Whether or not you have a trade-in. From the above seller is exempt from the Nebraska sales tax as a purchase for resale rental or lease in the normal course of our business either in the form or condition in which purchased or as an.

Nebraska Sales Tax Rate Finder. Nebraska Online Vehicle Tax Estimator Gives Citizens Tax. Money from this sales tax goes towards a whole host of state-funded projects and programs.

325 excise tax plus 125 sales tax 45 total for new vehicles 20 on first 1500 325 excise tax on balance 125 sales tax on full price total for used cars Estimator. There was a 25 percent difference between the two. Paid the first time a vehicle motorized or non-motorized is registered How to Calculate Vehicle Registration Fees DMVORG 77-6703There are four new provisions.

Nebraska Sales Tax on Cars. The requirement in the prior law that the school district property taxes paid by a subchapter S corporation partnership LLC or fiduciary must. In October 2005 the Nebraska Department of Motor Vehicles launched the Online Vehicle Tax Estimator an application that lets users preview what theyre in.

Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards Form 65 Sales and Use Tax Rate Cards Form 7 Sales and Use Tax Rate Cards Form 725 Sales and Use Tax Rate Cards Form 75 Sales and Use Tax Rate Cards Form Nebraska Application for Direct. If you live in the city limits of Bellevue Papillion La Vista Gretna or Springfield you need to select your city to get the correct sales tax computation. It means paying sales tax on the total sales price of the vehicle a 5 late penalty interest from 30 days after the date of purchase through the.

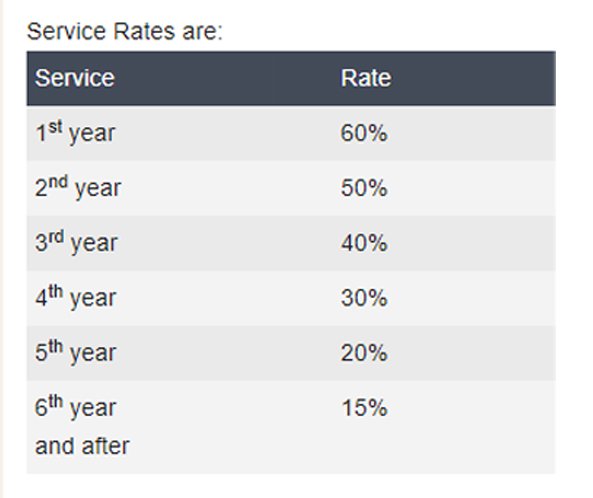

Find Your States Vehicle Tax Tag Fees When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. The motor vehicle tax and motor vehicle fee replaced the property tax levied on motor vehicles beginning Jan. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

The county the vehicle is registered in. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0824 on top of the state tax. When you register your car you must pay 15 for state registration fees.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. You must have the vehicles VIN vehicle identification number in order to get an estimate. The state of NE like most other states has a sales tax on car purchases.

Buying a car in Nebraska is subject to a vehicle sales tax like most other states. New car sales tax OR used car sales tax. You can find more tax rates and.

Next year there will be no sales tax due while the motor vehicle tax will decline to 630. You can obtain an online vehicle quote using the Nebraska DMV website. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts.

It is based upon the MSRP Manufacturers Suggested Retail Price of the vehicle. Car manufacturers may offer vehicle rebates to further incentivize buyers. The MSRP on a vehicle is set by the manufacturer and can never be changed.

5 of the sale price of a car is taxed in Nebraska. DMV fees are about 765 on a 39750 vehicle based on a percentage of the vehicles value. The amount of tax that you owe depends on the seller of the vehicle.

The Nebraska sales tax on cars is 5. Nebraska has a 55 statewide sales tax rate but also has 295. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax.

Use our calculator to determine your exact sales tax rate. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. This sales tax funds a wide range of projects and programs run by the state.

If the same truck was registered outside the city limits in York County which has no wheel tax and no local sales tax the bill would look like this. Divide the vehicle purchase price by 6 in order to calculate sales tax on the vehicle purchased from the dealership. Registration is required with each vehicle purchase to establish.

The registration fee in New England is 15. Nebraska sales and use tax rates in 2022 range from 55 to 75 depending on location. Motor Vehicle Tax is assessed on a vehicle at the time of initial registration and annually thereafter until the vehicle reaches 14 years of age or more.

In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees.

Taxes And Spending In Nebraska

Nj Car Sales Tax Everything You Need To Know

Dmv Fees By State Usa Manual Car Registration Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax On Cars And Vehicles In Kansas

Car Tax By State Usa Manual Car Sales Tax Calculator

Nebraska Income Tax Calculator Smartasset

Vehicle And Boat Registration Renewal Nebraska Dmv

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

States With Highest And Lowest Sales Tax Rates

Sales Tax On Cars And Vehicles In Nebraska

Car Tax By State Usa Manual Car Sales Tax Calculator

How The Nebraska Wheel Tax Works Woodhouse Nissan

Car Tax By State Usa Manual Car Sales Tax Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Nebraska Sales Tax Small Business Guide Truic

Dmv Fees By State Usa Manual Car Registration Calculator

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation